PORTRAIT OF A PIT MINE – BRENDA

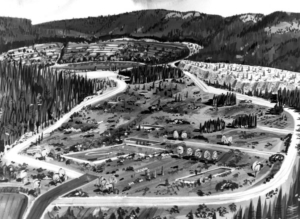

Morris M. Menzies, Vice President of Brenda Mines in 1970 asked, “Will it, as we are told by politicians, reporters and conservationists, despoil the countryside? Or will it be, as we affirm, an unqualified blessing to the people of this beautiful valley, the Province of British Columbia and the Canadian economy?”

The earliest record of the Brenda prospect appears in the Geological Survey of Canada Memoir No. 243, 1947. It was written by Dr. H. M. A. Rice following his field examination of the Copper King property above Peachland, in the summer of 1944. The Sandberg Brothers of Kelowna had for several years been working on a narrow quartz vein, well mineralized with copper pyrite and molybdenite, probably expecting to develop some tonnage of good grade gold and silver ore. Their claim was very near the centre of the the present Brenda pit mine. Work was stopped by the Sandbergs after Dr. Rice’s examination. The property was forgotten locally and the Survey’s report apparently failed to attract any wider attention.

In the early 1950’s, Bob Bechtel, a Canadian Army veteran from Hamilton, Ontario, settled in Penticton. Bob, a mechanic by trade, made a living by working in local garages and driving a school bus. Life was pleasant for Bob, and he found his greatest satisfaction in prospecting the mountains of the Okanagan Valley. Having had no training in prospecting, he bought a Jeep and books on the subject and diligently applied himself to being a traditional prospector.

Fortunately, Bob did not know -or if he did, he ignored the fact -that no economic mineral deposit had ever been found in the Okanagan Valley. Mining companies could not be persuaded to invest time or money in an area of so little potential.

On a bright summer day in 1954, Bechtel drove his Jeep up the old irrigation road towards Brenda Lake. The old irrigation district wagon trail from Peachland followed Peachland Creek for 18 miles to the Copper King claim and continued on to its terminus at Brenda Lake and another 2 miles to the west. In this distance, it climbed 4,400 feet from lake level to 5,600 feet at Brenda Lake.

Bob had not heard of the showing from the Sandbergs, or the G.S.C. report. High-grade chalcopyrite-molybdenite ore on the old dumps was a spectacular sight but Bob knew then that there was not enough of it. The huge tonnage of lightly mineralized fractured rock must make profitable ore or there would be no mine at Brenda Lake. With an intuitive faith in his discovery, Bob staked his first claims a few days later and began his long vigil over the Brenda property.

THE NORAND-KENNECOTT PROGRAMS

In the spring of 1955, Bechtel, having heard of the Noranda office in Vancouver, contacted the manager, Bern Brynelsen, and requested an examination of the Brenda property. Despite the low copper values obtained from Bob’s samples, Bern was never to lose interest in this intriguing prospect. Subsequent visits by Brynelsen and Morris Menzies, his assistant; led to an option agreement and plans for a program the next summer.

On April 17th, 1956 a party of 12 under Menzies’ direction drove to Brenda Lake and in 3 days, over 6 feet of packed snow, staked 80 claims around Bechtel’s key group. Three diamond drill holes were drilled that summer with the core returning an average copper value of 0.21 percent and partial assays indication about 0.03 percent molybdenum.

There was no established market for molybdenum and the copper content was far from ore grade, so it was not surprising when Noranda made known its intention to withdraw. Wishing to see further work done and attaching considerable importance to the presence of molybdenite, Brynelsen approached Kennecott, a major producer of that mineral in the United States, and proposed a joint program with Noranda the following year. This was approved and an agreement was signed that winter.

In June of 1957, Northwestern Explorations, Kennecott’s exploration company in British Columbia, began an aggressive program under the able direction of Engineer, Charlie Ney. In addition to claim surveying and the preparation of geology, fracture density and alteration maps (the first induced polarization program ever undertaken in B.C.), was run over the greater part of the present Brenda ore body. The only weak part of an otherwise excellent program was the pattern of X-ray holes, which were only 20 feet deep and showed considerable leaching. Ney suspected that, had the drill holes been 50 feet or more in depth, the mineral leaching would have shown successful value.

The winter of 1957-58 saw Noranda and Kennecott withdraw from the Brenda project and the property returned to Bob Bechtel. He requested and received help and advice from Brynelson and Menzies from that point onward.

THE YEARS OF WAITING

Bob ended up in a waiting period that was to last six years. There was no illusion of an early demand for Brenda’s low-grade rock but there was a determination to hold the property, if necessary, for fifty years. Data accumulated over two seasons of field work established, to the owners’ satisfaction, that Brenda had earned the right to an exhaustive test at an appropriate time determined by markets and advances in mining technology. Prospecting continued and two deep holes were drilled, the first in 1959 and the second in 1962, mainly for assessment purposes.

Two events of great importance took place in B.C. between the years of 1960-65 and set the stage for a comprehensive test of Brenda. One was the exploration and development of the Endako molybdenum property by Placer Development, Fraser Lake, which led to successful production in the spring of 1965. Concurrently, Noranda Mines explored, developed, and began to produce from the Boss Mountain molybdenum prospect in William’s Lake.

The importance of Boss Mountain was that it gave Brynelsen and Menzies the experience and knowledge required for the proper evaluation of a moly prospect.

By June 1964, it was evident that the meticulous work of Placer and their consultants, Chapman, Wood & Griswold Ltd., on Endako would pay handsome dividends. Menzies decided the time was ripe for a comprehensive test of Brenda. In a discussion with Brynelsen, it was agreed that Brenda had greater size potential than Endako and the Boss Mountain experience suggested the molybdenum grade might be twice that obtained in the 1956 program. Brynelsen was off and running.

The old reports were unchanged and there was no new data to present. The grade appeared hopelessly low and speculative arguments were unconvincing. Noranda declined further involvement but, to the company’s lasting credit, permitted Brynelsen and Menzies to proceed on their own. It was agreed at this point that Ted Chapman, President of Chapman, Wood & Griswold Ltd., would be asked to conduct an examination of Brenda and, if interested, would managed the project.

Through the summer months, every major Canadian, American, and Japanese mining company resident in Vancouver was approached. In turn, with one exception, they all courteously declined to participate, a fact that led Brenda’s sponsors to feel that their collective reason was subject to considerable doubt.

The exception was Nippon Mining Company, which was willing and apparently anxious to take all of the action. But Government policy required Canadian control and imposed a limit on Japanese participation.

On October 18, 1964, Ted Chapman, accompanied by Brynelsen, examined the Brenda property. His report, dated November 20, 1964, was compiled after an exhaustive study of all available data; it was cautiously optimistic and recommended a $30,000 program of photo-geology, geochemistry, percussion drilling and shallow shaft sinking.

As spring approached, the property owners turned their attention to the Brenda claim. Having had dealings with Mervin E. Davis of Pentiction two years earlier, Brynelsen outlined the proposed Brenda program to him and a few associates. Merv and his friends were quickly sold on the project and contributed an amount equal to Nippon’s allotment. The balance of the funds required was quickly raised from other sources. Merv, a chartered accountant and a business man of outstanding ability, joined the management group in due course and remained to become a director and vice president in charge of finance of Brenda Mines Ltd. On April 30, 1965, Chapman issued a report in which the estimated cost of the Brenda program was increased to $40,000. Management, facing heavy expenditures for legal surveys and contemplating an expanded program, decided to raise $140,000 through a seven-unit financing syndicate.

An option was taken from the Deep Creek Mining Syndicate, the registered owner of the Brenda claims. The claims were held for a time by A. W. Fisher in trust and later transferred to Northlands Explorations Limited, a private company acquired for use as the eventual successor of the Brenda Mining Syndicate.

In a report dated December 15, 1965 Chapman’s summary stated, “Results…indicate that actual content of copper and molybdenum are higher than earlier estimates and tests indicate that at least 85 percent of both copper and molybdenum can be recovered and there should be no unusual problems in separating them into separate products at suitable grades.

Net returns from metal sales at the indicated recoveries and grades with metal prices of 32 cents per pound for copper and $1.55 per pound for molybdenum should be approximately $3.00 per ton. At the indicated grade and recoveries, an operation at 10,000 tons per day should generate profits sufficient to repay investment and pay 10 percent compound interest on unpaid capital, provided at least 70 million tons of ore are available.” The Brynelsen-Menzies theories had been vindicated.

The program, commencing in early January 1966, was to take 15 months to complete at a cost of $3.5 million. A technical committee, comprising Brynelsen, Menzies, Davis and representatives of all consulting and legal firms, was established and met weekly to discuss all phases of the project. John Wood, Noranda started providing major financing for the project in June 1966 and, equally important, made available to Brenda the services of some of their most outstanding experts in mining, milling, and assaying. In the spring of 1967, formalized later by agreement dated 4 January 1968, management control was assumed by Noranda.

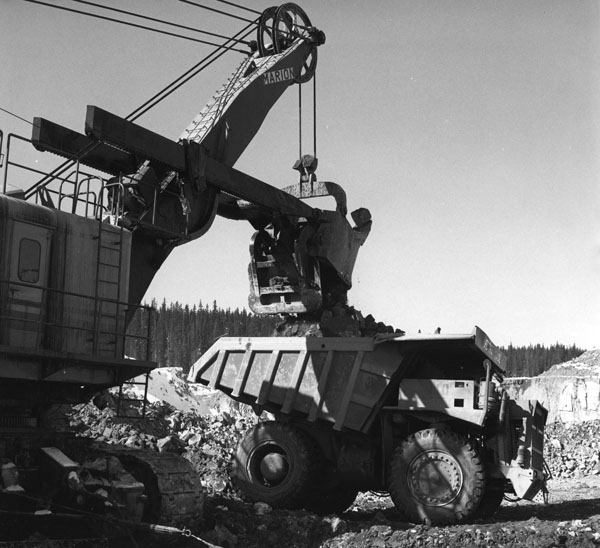

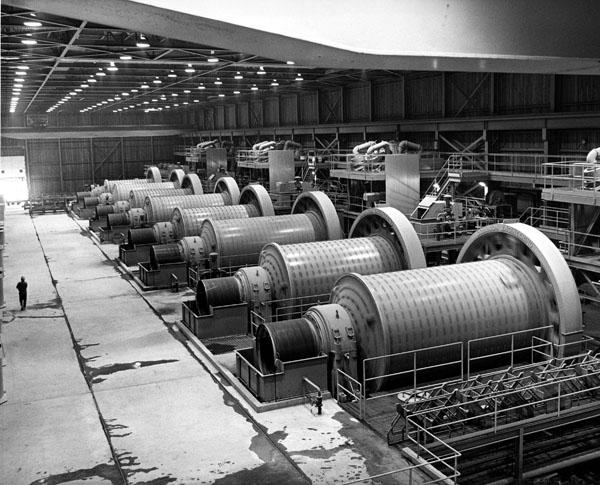

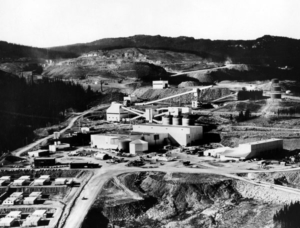

Mining began in late fall and mill construction commenced in March 1968. Mine preparation and plant construction costing some $62.5 million was an immense and complex undertaking.

The mine operated continuously until the ore was depleted in 1990, producing 278,000 tonnes of copper, 66,000 tonnes of molybdenum, 125 tonnes of silver and 2 tonnes of gold. 300 million tonnes of rock was removed to process 182 million tonnes of ore. The B.C. Ministry of the Environment was involved in the closing of the pit mine between 1990 and 1998; requiring reclamation of the site. Buildings were removed and tailings contoured. Seeding and planting of the area has encouraged the return of wildlife. The company installed a water processing plant to deal with the accumulation of runoff water in the pit prior to releasing it into the domestic water system of Peachland.

Over the years, the companies of Brenda Mines Ltd. contributed funds to many Peachland projects and organizations. Peachland Museum was one of those recipients.

References:

Noranda Mines Annual Report 1969

Glencore Xstrata 2013

Peachland Museum and Archives

The Photography of Croton & Jennings Studios